Tawarruq is a transaction where one party buys some goods on credit at a marked-up price and sells the same at a lesser value for the purpose of getting cash (i.e. the spot value of the goods). The purpose of this transaction is not the possession of the goods, but the obtainment of liquidity.

The parties to a tawarruq transaction are the seller or creditor ("musawwariq") and the purchaser ("mutawarriq" or "mustawriq").

Tawarruq contracts developed as a means of getting ready cash (and on the part of the party providing the cash, of granting financial assistance and being compensated for it) whilst circumventing the prohibition against the payment and charging of interest.

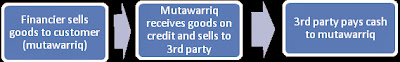

An illustration of the basic tawarruq process:

Nowadays, it is commonly used by Islamic banks as a mode of financing (for example, for personal financing) as well as an important tool for liquidity management (for example, by means of short-term placement mechanism involving the sale and purchase of commodities on the international commodities market i.e. commodity murabaha).

An example of the current utilisation of tawarruq is as offered by HSBC Amanah's Personal Finance, where the customer buys metals from the bank at a pre-agreed profit margin (which sum is payable in instalments), and then sells the metals on the customer's behalf to an international broker (wthe proceeds of which sale is transferred into the customer's account.

Bank Muamalat Malaysia Berhad also utilises tawarruq in its Muamalat Cash-Line Facility-i, which is offered for working capital purposes.

The basic form of tawarruq is considered permissible by all four schools of Islamic thought.

Types of Tawarruq:

"Classical tawarruq" or "real tawarruq" is the traditional method of tawarruq whereby the financier sells the goods to the mutawarriq, who then disposes of the goods in the open market.

"Organised tawarruq" or "managed tawarruq" is the term bestowed on the type of tawarruq practised by Islamic banks today, i.e. where the financier manages the tawarruq process. One example is when the financier sells the goods to the mutawarriq, financier or its nominee is then appointed the mutawarriq's agent to on-sell the goods on his behalf on the open market.

"Reverse tawarruq" is similar to organised tawarruq but where the bank is the mutawarriq/customer seeking liquidity.

The Difference Between Tawaruq and Bai Inah:

Bai Inah is a mode of financing wherein the financier sells goods to the customer on credit terms, with a mark up of the price, and subsequently purchases the same goods from the customer at the spot price.

Although Bai Inah is accepted in Malaysia, it has not been accepted as a shariah-compliant financing instrument in the Middle East as it is considered a legal fiction, in that there is a buy-back of the goods on the part of seller; therefore the sale and purchase transaction is merely to create a debt obligation which is no different from, or tends to lead to, usury.

Usury is not permitted in Islamic transactions, pursuant to the oft-quoted Quranic source, Al-Baqarah:275 -

"Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, "Trade is [just] like interest." But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah. But whoever returns to [dealing in interest or usury] - those are the companions of the Fire; they will abide eternally therein."

Tawarruq is distinguished from Bai Inah in that there is no buy-back; rather, the mutawarriq is free to dispose goods to any other party on the open market. Therefore, it is seen as a true sale and therefore permissible.

Tawarruq Now:

As previously stated, tawarruq is, among others, an important tool for Islamic banks to manage their liquidity requirements. It is also seen as a shariah-compliant alternative to Bai Inah.

However, the Fiqh Academy of the Organisation of Islamic Conference ("OIC Fiqh Academy"), has, by its Resolution No. 179 (19/5) at its 19th Session held on 26-30 April 2009, held that although classical tawarruq is permissible (so long as it complies with the requirements of sale transactions), organised tawarruq and reverse tawarruq are not permissible.

Even so, in the absence of a more suitable mode of transaction, tawarruq continues to be utilised by Islamic banks. Indeed, some scholars have even argued for the continued use of tawarruq, albeit with some changes so as to strengthen the structure so as to avoid those practices which violate the shariah.